How Risk Tolerance Shapes Your Growth Strategy

When it comes to growth, not all companies are starting from the same place, or playing with the same appetite for risk.

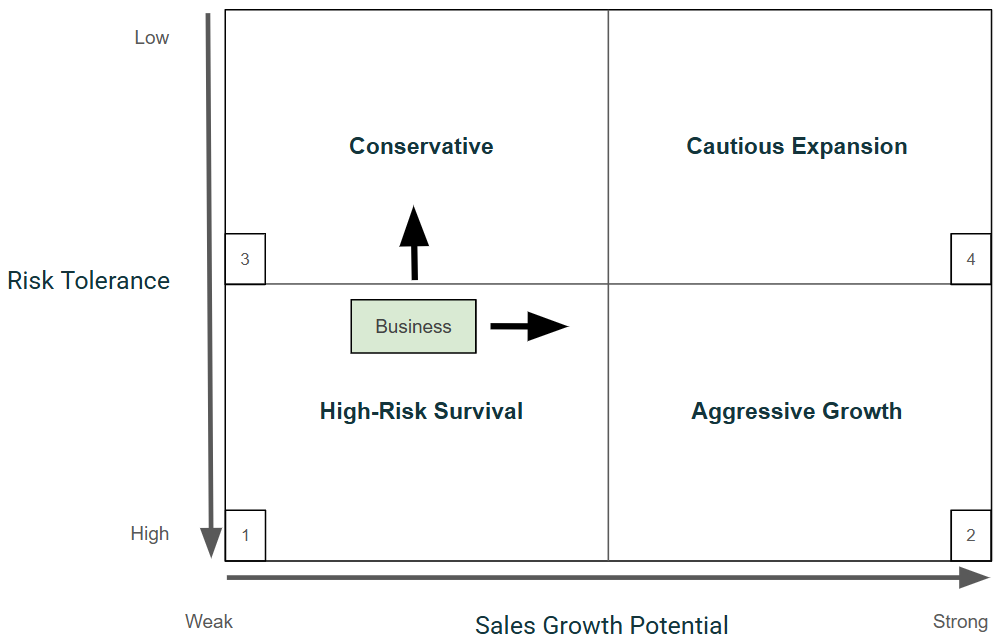

That’s why a simple 2x2 strategy matrix mapping Sales Growth Potential against Risk Tolerance can offer powerful insight into where your business stands, and where it should be heading.

Created by Jeff Nelson

This model is especially helpful for consultants and business owners navigating difficult terrain. Some companies are struggling just to stay afloat. Others are poised for expansion but hesitant to move too fast. Understanding where you are can help you chart a better path forward.

The Matrix: Risk vs. Growth Potential

Here’s how the matrix breaks down:

X-Axis: Sales Growth Potential (from Weak to Strong)

Y-Axis: Risk Tolerance (from High to Low)

Each quadrant reveals a distinct mindset and strategy:

1. High-Risk Survival – “Treading water”

Low Growth Potential / High Risk Tolerance

These companies are in a vulnerable spot. They’re often under financial pressure, short on resources, and forced to take risks just to stay in business. It’s not a strategy, it’s just survival mode.

Typical signs:

Inconsistent or declining sales

High operating risk or cash flow problems

Short-term decision-making

Goal: Stabilize. Reduce exposure. Reassess the model.

Example: CannTrust Holdings – Before its collapse, the cannabis company was taking aggressive bets while facing mounting regulatory and financial pressure. It didn’t end well.

2. Conservative – “Slow, steady, and safe”

Low Growth Potential / Low Risk Tolerance

These businesses are stable, well-managed, and typically profitable, but they avoid big moves. This quadrant includes legacy companies, utilities, and niche service providers that prioritize predictability over expansion.

Typical signs:

Reliable revenue with slow but significant innovation

Hesitancy to adopt new technology or enter new markets

Preference for incremental improvements

Goal: Explore low-risk growth channels, perhaps adjacent markets or partnerships.

Example: ATCO Ltd. – With its focus on utilities and infrastructure, ATCO is built on long-term contracts and a conservative operating model.

3. Aggressive Growth – “Full throttle, high stakes”

High Growth Potential / High Risk Tolerance

These companies are going after market share hard and fast. They often take on debt, hire quickly, or expand globally before the foundation is fully built. Sometimes it pays off; sometimes it crashes.

Typical signs:

Heavy marketing or R&D investment

Growth at the expense of profitability

Rapid scaling without guardrails

Goal: Maintain momentum, but monitor burn rate, culture, and customer retention.

Example: Shopify – In its early years, Shopify aggressively expanded into global e-commerce infrastructure, often operating at a loss in pursuit of long-term dominance.

4. Cautious Expansion – “Growing with confidence”

High Growth Potential / Low Risk Tolerance

This is the sweet spot. Companies in this quadrant have the potential to grow and the discipline to do it wisely. They test new markets before committing, keep overhead in check, and scale when they’re ready, not just when it’s trendy.

Typical signs:

Strategic acquisitions or pilot programs

Strong cash reserves and operational efficiency

Measured expansion plans

Goal: Stay the course. Optimize what’s working and keep risk in proportion to opportunity.

Example: Save-On-Foods – Headquartered in British Columbia, Save-On-Foods continues to expand across Western Canada using a disciplined, regional growth strategy. They’ve embraced online ordering and loyalty programs without overextending into high-risk territory.

Why This Matrix Matters

Your business’s position in the matrix should shape every major decision from budgeting and hiring to marketing and investment. Here’s what to consider:

If you’re in High-Risk Survival: Prioritize stabilization. Cut unnecessary costs and seek cash-flow clarity.

If you’re in Conservative: Explore safe bets, like improving operations or bundling services, to unlock growth.

If you’re in Aggressive Growth: Make sure your infrastructure can keep up. Speed kills if it’s not managed well.

If you’re in Cautious Expansion: You’re in a great place. Stay focused, stay humble, and don’t get complacent.

Final Thought: Movement is the Goal

No company should remain stuck in one quadrant forever. The goal isn’t to stay put, it’s to move wisely. Most of my clients in High-Risk Survival aim to shift into Cautious Expansion or Aggressive Growth, depending on their market and leadership style. Others in the Conservative quadrant want help unlocking their potential while keeping risk under control.

Knowing where you are and where you want to be gives you clarity. Moving intentionally and strategically is where the real progress happens.