Should I Focus on Profit or Revenue?

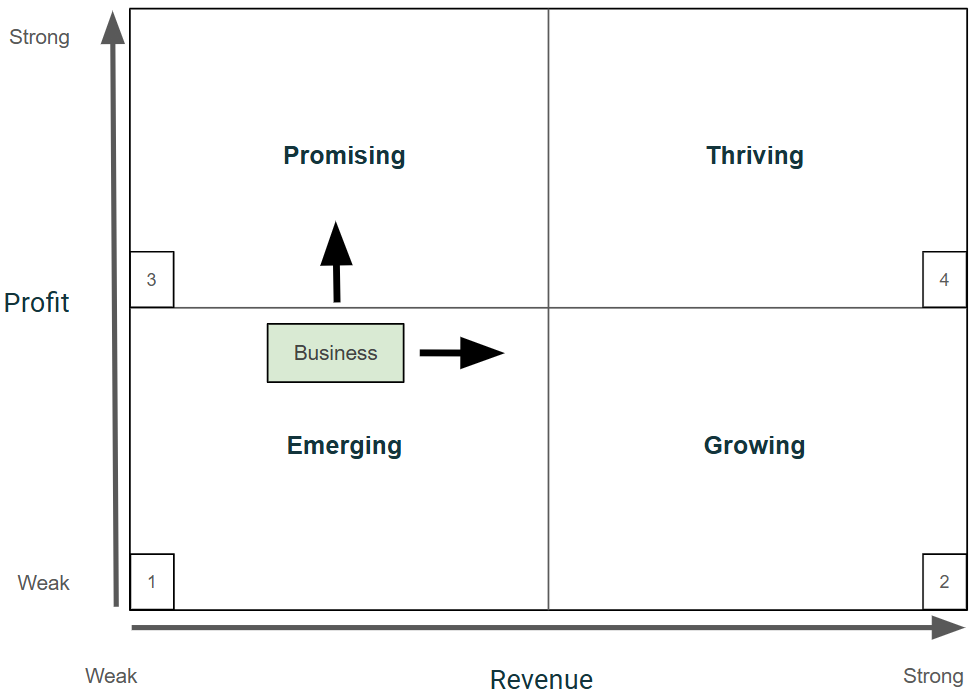

When evaluating a business or marketing strategy, one of the most important questions you can ask is: Should I prioritize revenue or profit?

This 2x2 matrix offers a visual framework to assess your current position and guide your next steps.

The vertical axis represents profitability, while the horizontal axis shows revenue scale.

Created by Jeff Nelson

Let’s explore each quadrant:

Quadrant 1: Emerging (Low Revenue, Low Profit)

These businesses are typically in the early stages or operating in an experimental phase. They haven’t yet achieved scale or profitability, but may be testing new models, products, or markets.

Strategic Focus:

Validate the business model

Keep an eye on the burn rate

Seek product-market fit

Canadian Examples:

Clearco – Initially tested alternative startup financing models, supported by TechCrunch.

FarmLead – An agri-tech startup with early traction but challenges in scaling (BetaKit).

Quadrant 2: Growing (High Revenue, Low Profit)

These companies are scaling quickly and generating substantial revenue, but haven’t yet turned a profit due to heavy investment in growth.

Strategic Focus:

Improve operational efficiency

Monitor margins

Move toward profitability

Canadian Examples:

Lightspeed Commerce – Grew through global acquisitions while operating at a net loss (Financial Post).

Wealthsimple – Rapid user and asset growth, but long-term profitability is still evolving (Globe and Mail).

Quadrant 3: Promising (Low Revenue, High Profit)

These are often niche businesses with strong profit margins but modest revenue. They're ripe for growth if they can scale operations without sacrificing profitability.

Strategic Focus:

Invest in customer acquisition

Explore new markets

Maintain operational discipline

Canadian Examples:

Knix – A direct-to-consumer (D2C) intimate apparel brand that achieved healthy margins in its early growth years (Canadian Business).

FreshBooks – Accounting software for small businesses with a loyal user base (Forbes).

Quadrant 4: Thriving (High Revenue, High Profit)

These companies have achieved both scale and profitability. They operate efficiently, enjoy brand strength, and have strategic clarity, but they still need to evolve to stay ahead.

Strategic Focus:

Defend market position

Innovate carefully

Expand strategically

Canadian Examples:

Shopify – A global e-commerce platform that balanced growth and profit during its peak post-IPO years (Investor Relations).

Lululemon Athletica – A premium apparel brand with strong brand loyalty, high margins, and global presence (Lululemon Investors).

Final Thoughts

Whether you're a startup founder, marketer, or executive, understanding your current position on this matrix can help guide where to focus your strategy.

Do you need to scale more?

Do you need better margins?

Or both?

Spoiler: The best companies manage to do both. But the path there depends on where your company is starting.

P.S. I used ChatGPT to help with finding Canadian companies.