Who Sees the Sign Above the Toilet?

During a recent stint as a relief manager at the Kananaskis Wilderness Hostel, I found myself in a position to observe the intersection of customer behaviour and physical messaging. It was an observation made in the restroom, but it provided a stark lesson in the fundamentals of marketing strategy.

AI has Replaced my Father

In a world of search engines, AI and LLM, I find that I am often asking questions and looking for answers. Now, we ask AI like Gemini or ChatGPT to answer our complex questions, provide historical context, or offer a perspective on a difficult problem. That is a role that my father had. Lately, every time I type a prompt into a chat box, I find myself thinking of my father, Cliff Nelson.

Featured Alliance Partner: Craig Comstock

Craig Comstock spent over 20 years learning that most businesses don't need more "theory." They need a plan that works and eventually ends. Instead of a vague, open-ended arrangement, he breaks work down into defined phases with clear outcomes.

Featured Alliance Member: Nat Miletic

Nat is the owner of Clio Websites, and he has been quietly doing solid, thoughtful website work for a long time. The kind of work that does not need a drum solo, a funnel diagram, or a six-part manifesto to explain itself.

Measuring Marketing Performance Without Drowning in Data

More data does not lead to better marketing decisions. Clarity comes from focusing on a small set of metrics that connect marketing activity to revenue, conversion quality, and real engagement. Marketing performance is a frequent topic. Most discussions are about dashboards, reports, weekly numbers, and monthly reviews.

The Value of Sliding Doors

Sliding doors don’t demand effort. Great marketing works the same way. The best systems don’t require prospects to figure things out. They remove friction. They anticipate needs. They open at exactly the right moment.

A Lament: It Should Have Been Safe

A lament for the Jewish families whose loved ones were killed on Bondi Beach during Hanukkah celebrations on December 15, 2025.

What Is Your Punch Line?

Most businesses overload on “setup” (features, tools, credentials) but forget the punch line: the real value they deliver. Inspired by Michael Jr.’s TED Talk, this post explores why great marketing starts with giving, not getting.

Women at the Helm – Unprecedented

A record number of women now serve as presidents and prime ministers around the world, reshaping what global leadership looks like. Their achievements bring fresh perspectives, proven strength, and real progress toward more inclusive and representative leadership.

I Failed. There, I Said It Out Loud.

I failed my Class 2 bus-driver road test, but in the process, I learned lessons about momentum, humility, and how marketing often requires the same patience as driving a school bus.

The Next Level: The Power of Alliance

For years, Anduro was known for helping companies grow online through SEO and Google Ads. Those tools still matter, but today’s marketplace demands more. Growth isn’t just about traffic; it’s about clarity, trust, and execution across every touchpoint.

That’s why we created Anduro Alliance. It’s not just a new name. It’s a new way of working: a partnership of seasoned specialists who bring together strategy, creativity, and technology under one banner.

Build a GBP Scoreboard Before Your Coffee Gets Cold

For most mid-size businesses, Google Business Profile (GBP) is the most powerful marketing channel they have. It’s the first thing potential customers see in local search, and it often determines who gets the call, the click, or the job.

Here’s the problem: most companies don’t measure GBP in a meaningful way. They glance at Performance now and then, but they don’t connect the dots between visibility and actual leads.

The good news? You can set up a live GBP Scoreboard in Looker Studio in about the same time it takes to finish your morning coffee.

Breaking Through the Marketing Noise

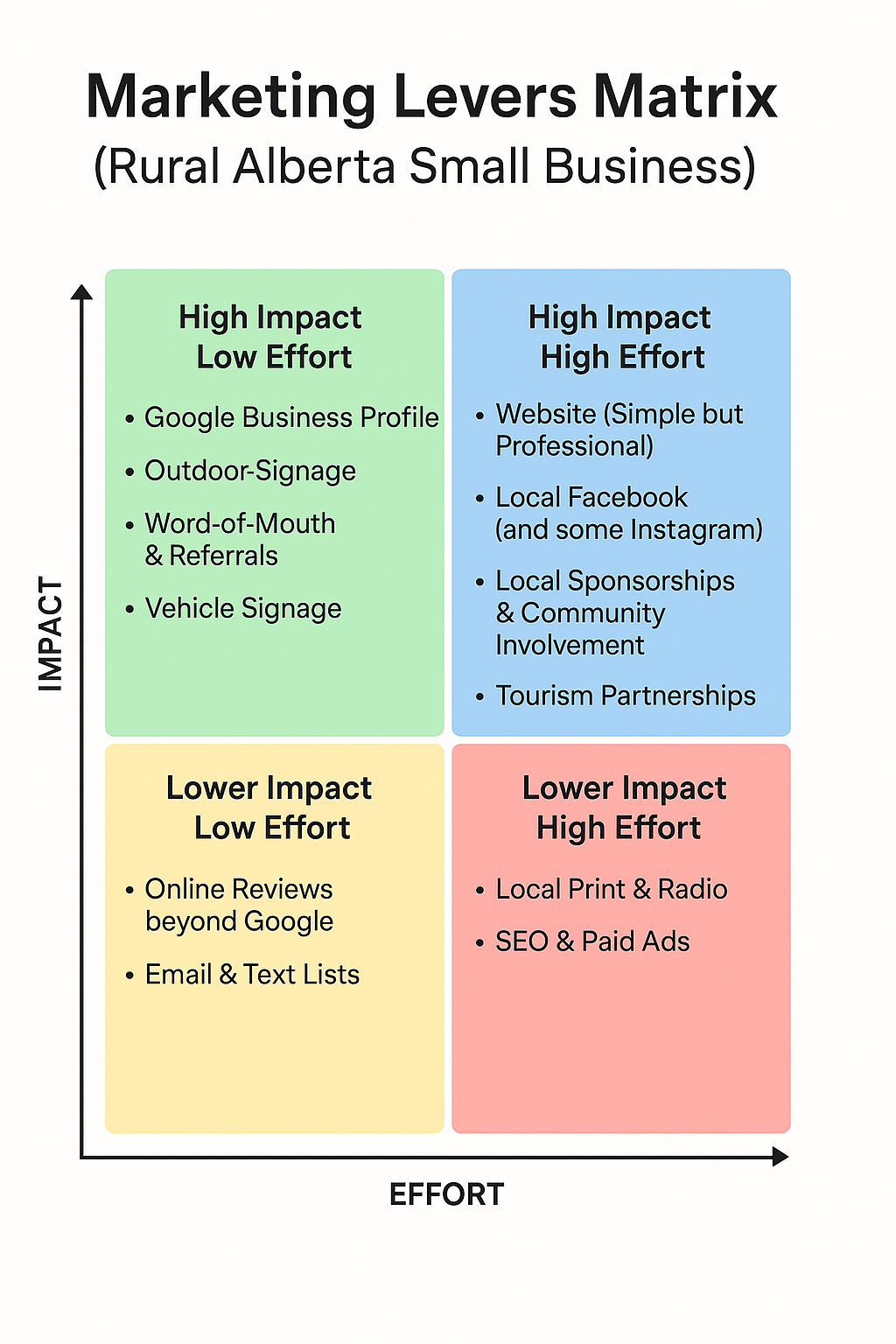

Attention is scarce. Whether you’re a small business in rural Alberta or a Fortune 500 brand, you’re fighting for visibility in an environment where marketing channels are bursting at the seams.

So why has this happened? And more importantly, what should businesses do about it?

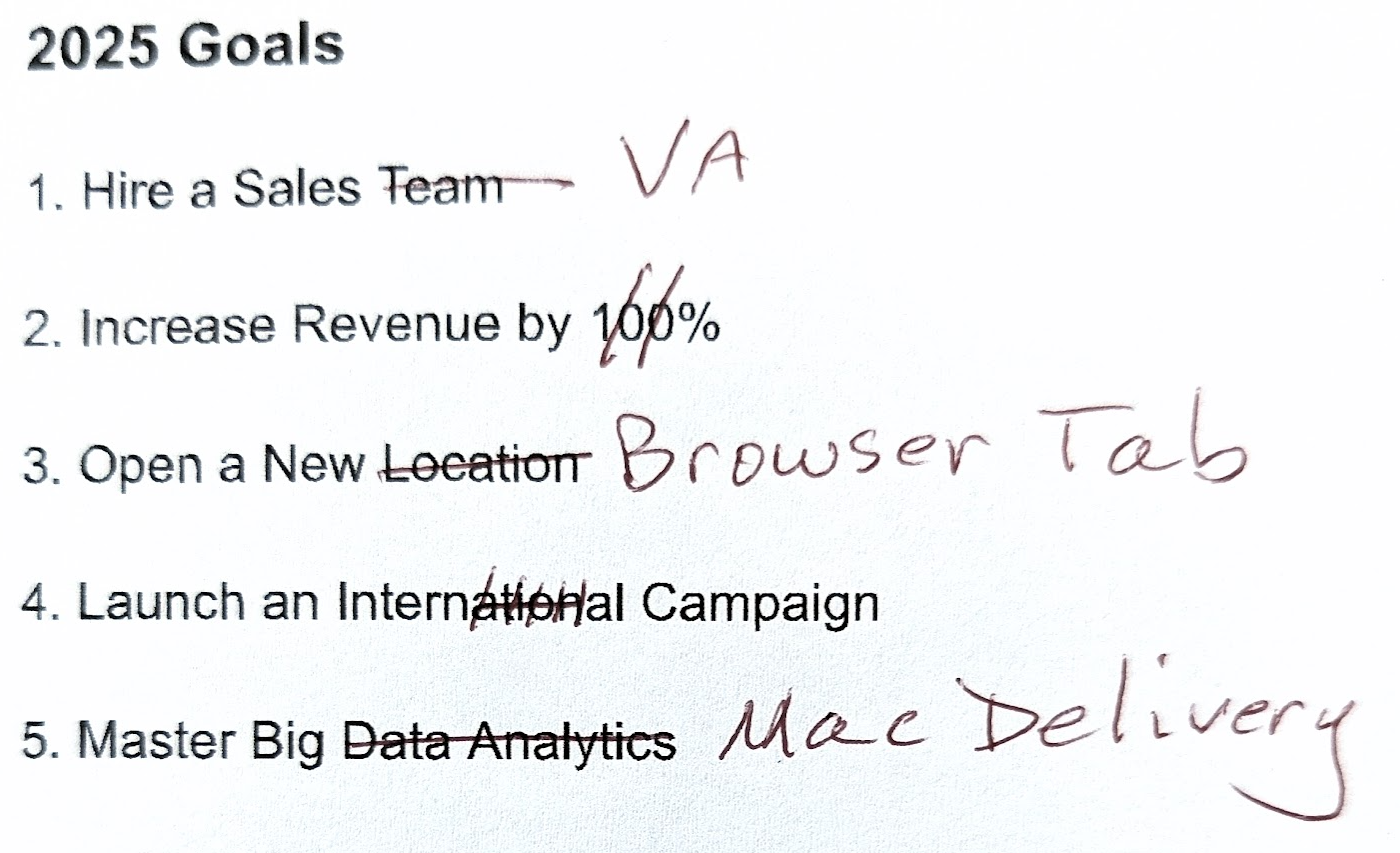

Marketing Levers That Matter the Most for Small Businesses

The truth is, not all marketing channels are created equal. Some deliver results quickly and consistently, while others drain your time and budget with little return. The key is knowing which marketing levers to pull first.

How Bananas, ChatGPT, and Marketing Tie Together

Turns out tracking carbs, chasing targets, and avoiding shiny distractions isn’t just for weight loss — it’s for marketing too.

I lost 15 pounds in two months using ChatGPT as my accountability partner. The lessons I learned about weight loss — tracking, focus, and discipline — are the same ones I use in marketing.

The Visibility Ladder: Why Marketing Matters

If nobody knows you exist, nothing else matters. Being known is the first step to being trusted, chosen, and eventually referred. Visibility is the foundation of growth.

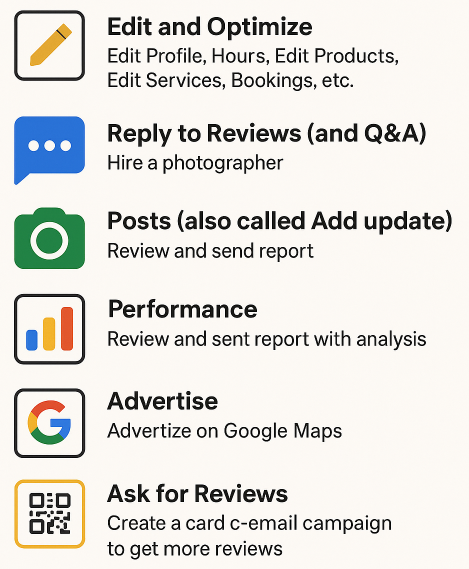

Google Business Profile: So Much To Do, So Little Time

Managing a Google Business Profile (GBP) can feel overwhelming. It’s not a one-and-done setup—there’s a surprising amount to update, optimize, and maintain if you want to get the most out of your listing. Whether you're doing it yourself or getting help, here’s a checklist of high-impact actions to keep your profile performing at its best.

Florence Nightingale Would’ve Crushed It in Marketing

Most people remember Florence Nightingale as the lady with the lamp—the compassionate nurse who cared for wounded soldiers during the Crimean War. But dig a little deeper, and you’ll discover she was also a data analyst, persuasive communicator, systems thinker, and relentless reformer. In other words, she has all the characteristics of a modern marketer.

Who Still Uses Business Cards? (Seriously, Who?)

Discover why business cards are obsolete in 2025 and what modern professionals are using instead.

Google is Dead

Is Google still king of search? Yes, but there are alternatives. This blog post explores how AI tools like ChatGPT are reshaping the way people search for information and what marketers need to do about it.